Financial services firms run on processes. Every transaction, onboarding flow, compliance check, approval, reconciliation, and report follows a defined path. As businesses grow, these paths become longer and more complex. What once worked with spreadsheets and emails starts to slow teams down.

This is where workflow automation becomes critical.

Workflow automation in financial services is not about replacing people. It is about reducing friction, removing repetitive work, and making sure critical processes run consistently every time. Whether it is a fintech startup, a mutual fund distributor, an NBFC, or a growing advisory firm, automation helps teams scale without losing control.

This article explains what workflow automation really means in the context of financial services, where it adds the most value, and how modern companies are implementing it in a practical and sustainable way.

Why Financial Services Struggle With Manual Workflows

Financial services is one of the most process heavy industries. Every operation touches multiple systems and multiple teams. A single customer onboarding may involve KYC verification, document checks, internal approvals, account creation, and communication with the customer. Each step often depends on data moving correctly from one system to another.

In many organisations, this movement still happens manually. Someone downloads a file, uploads it elsewhere, checks details, sends an email, waits for a response, and updates a spreadsheet. This works at a small scale but quickly breaks down as volumes increase.

Manual workflows create delays. They increase the risk of errors. They make audits harder. Most importantly, they consume time that skilled teams should be spending on analysis, advice, or growth.

Workflow automation addresses these problems by connecting systems, enforcing rules, and ensuring processes move forward without constant human intervention.

What Workflow Automation Means in Financial Services

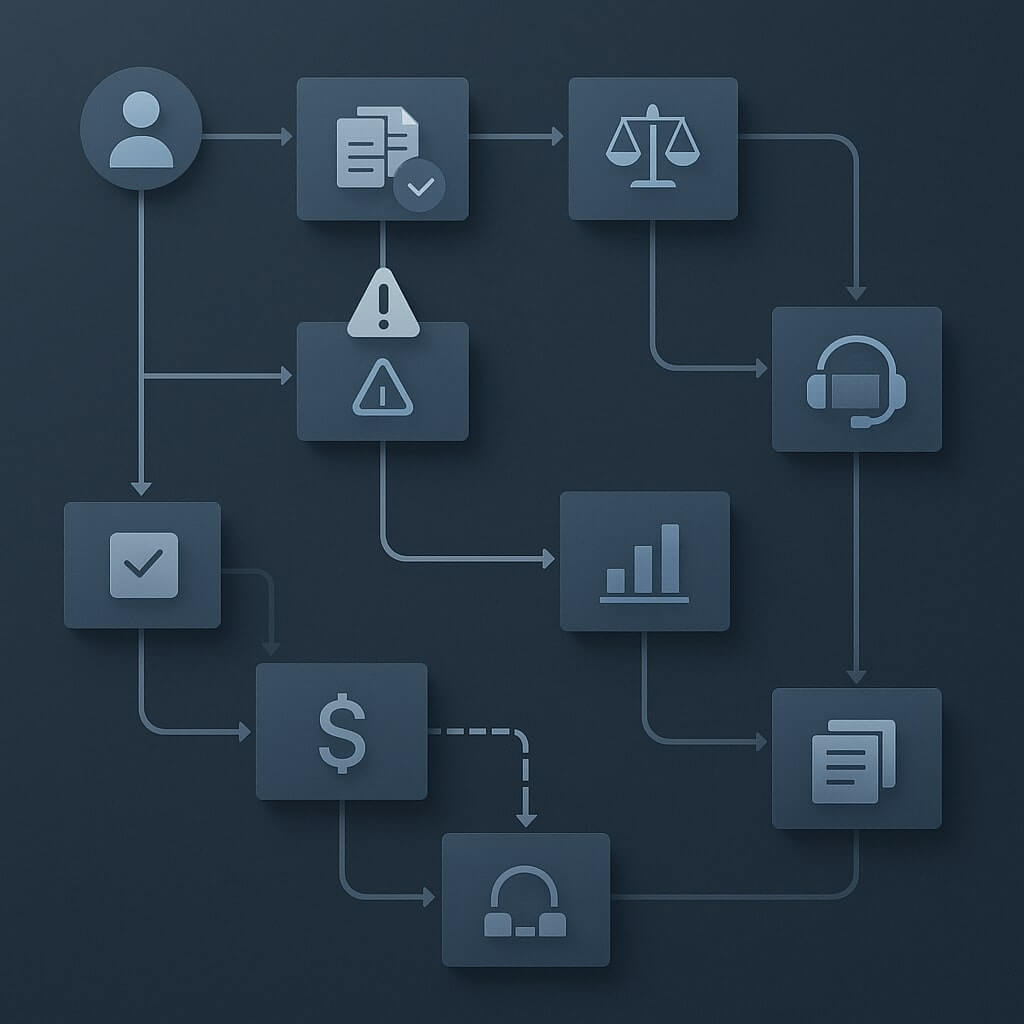

Workflow automation is the design of systems that execute business processes automatically based on predefined rules. In financial services, this usually means connecting internal systems, external APIs, databases, and communication tools so that data flows smoothly without manual handling.

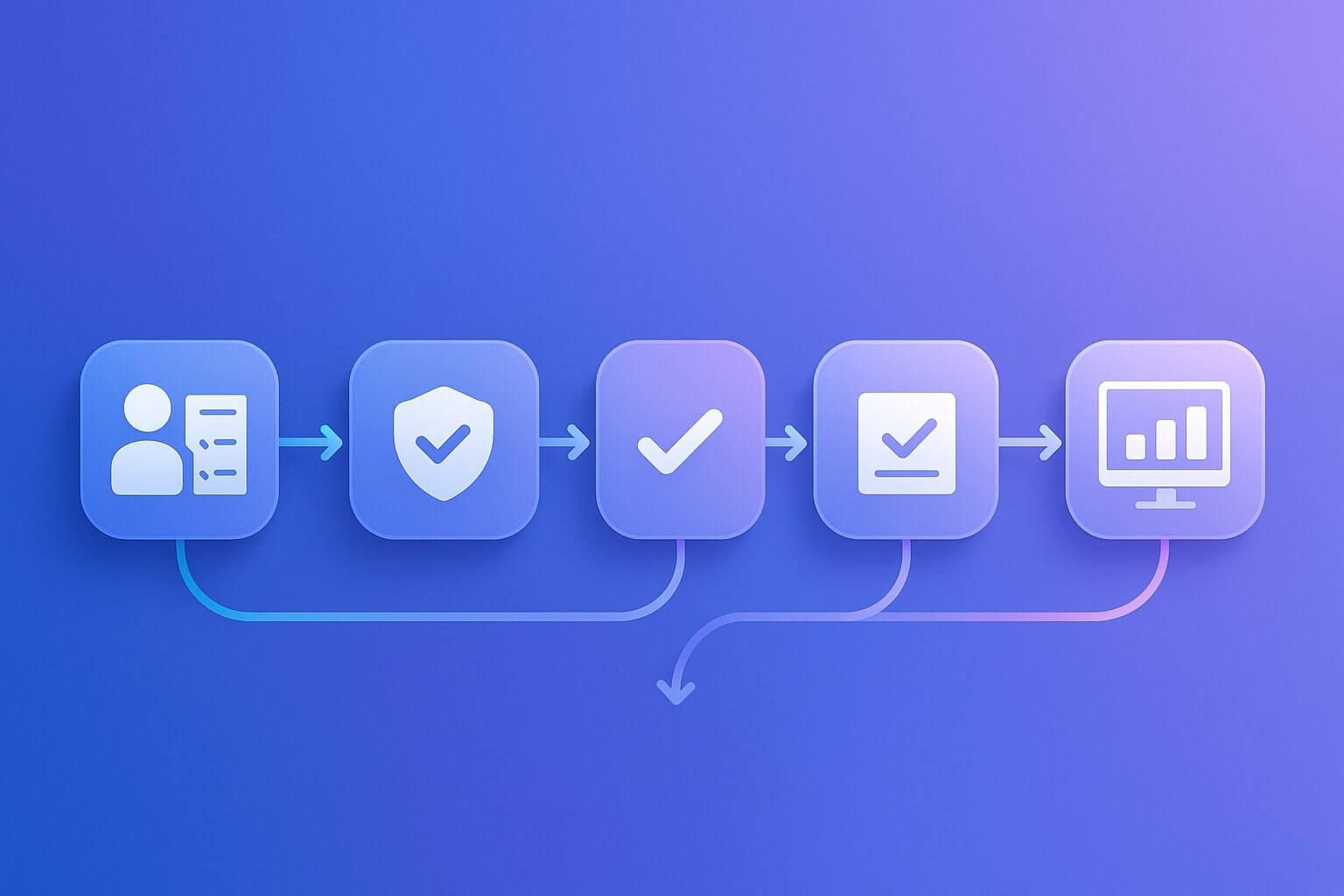

For example, when a customer submits onboarding details, an automated workflow can validate the data, trigger KYC checks, notify the compliance team, create records in internal systems, and send updates to the customer. Each step happens in the right order and leaves an audit trail.

Automation does not remove human decision making. Instead, it ensures that humans step in only when judgment is required. Everything else happens automatically and consistently.

Common Areas Where Workflow Automation Is Used

Most financial services organisations start automation in areas that are repetitive and time sensitive.

Customer onboarding is often the first candidate. Automation helps validate data, check documents, run KYC workflows, and ensure no step is missed.

Compliance and reporting is another major area. Automated workflows can collect data from multiple sources, prepare reports, flag anomalies, and notify teams when action is required.

Operations teams use automation to reconcile transactions, update records, generate statements, and manage approvals. Finance teams rely on automation to prepare daily, weekly, or monthly reports without manual effort.

Customer communication also benefits from automation. Notifications, reminders, confirmations, and alerts can be triggered automatically based on events rather than manual follow ups.

Why Traditional Automation Approaches Fall Short

Many financial institutions have experimented with automation before. Often, the experience is mixed.

Traditional RPA tools rely on mimicking human actions on screens. These solutions break when interfaces change and are difficult to maintain. They also require specialised skills and high licensing costs.

Basic integration tools work well for simple connections but struggle with complex workflows involving conditions, approvals, error handling, and compliance requirements.

Financial services need automation that is reliable, auditable, flexible, and secure. This is why modern workflow automation platforms are gaining adoption.

Modern Workflow Automation Using Open Systems

Modern automation platforms like n8n approach the problem differently. Instead of controlling screens, they work directly with APIs, databases, and events. This makes workflows more stable and easier to scale.

Workflows can start based on events such as a form submission, a database update, a scheduled trigger, or an incoming API request. From there, the workflow can validate data, call external services, apply business rules, wait for approvals, and log every step.

Because these platforms are code-friendly but not code-heavy, they allow teams to build automation that reflects real business logic without excessive complexity.

For financial services, this approach aligns well with compliance and security needs.

Key Benefits of Workflow Automation in Financial Services

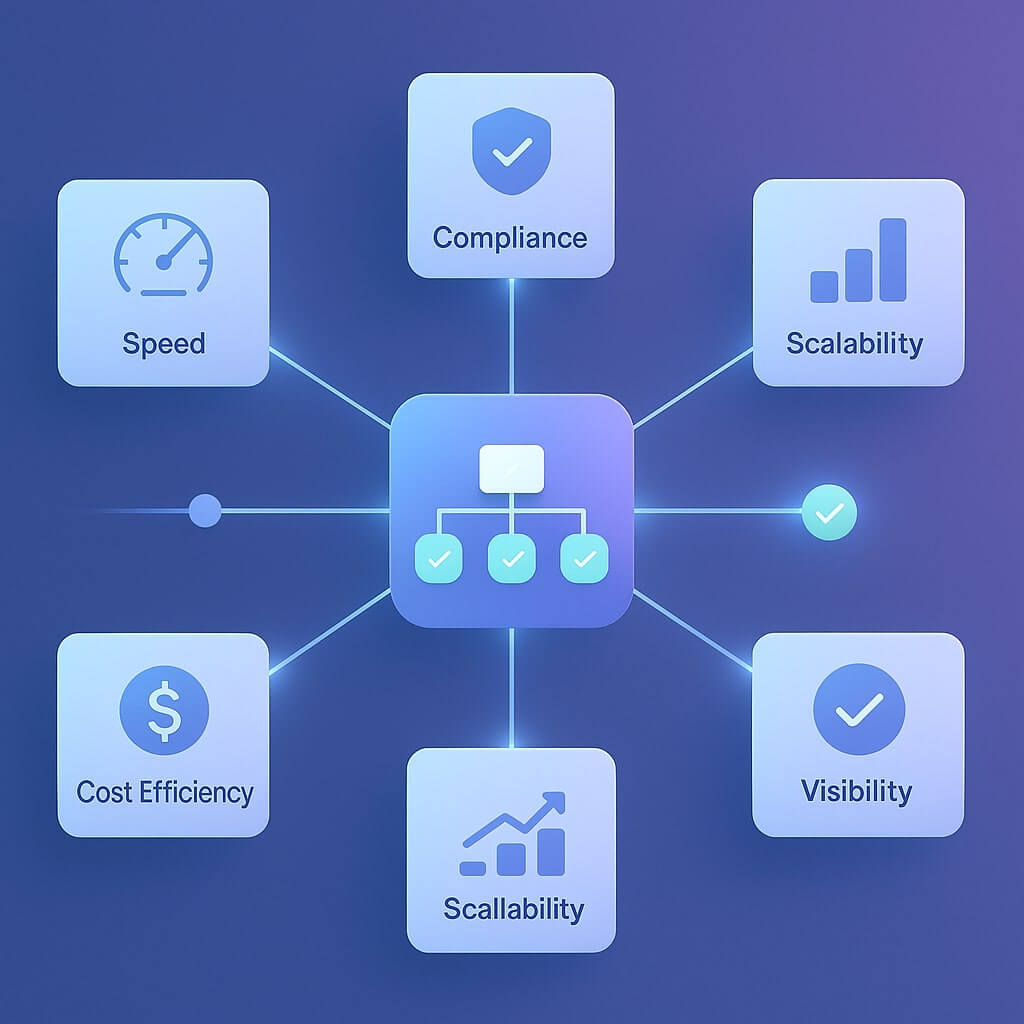

One of the biggest benefits is consistency. Automated workflows execute the same way every time. This reduces operational risk and improves audit readiness.

Another benefit is speed. Processes that used to take hours or days can run in minutes. This improves customer experience and internal efficiency.

Automation also improves visibility. Teams can see where a process is stuck, what has been completed, and what requires attention. This makes management easier and reduces dependency on individual employees.

Over time, automation lowers costs by reducing manual effort and rework. It also improves employee satisfaction because teams spend less time on repetitive tasks.

Security and Compliance Considerations

Automation in financial services must be built with security in mind. Sensitive data should be encrypted. Access should be controlled. Every action should be logged.

Well designed workflows include audit trails, role-based approvals, and clear ownership of steps. This makes compliance audits smoother and reduces regulatory risk.

Self hosted or controlled automation platforms also give organisations confidence that data does not leave approved environments.

How Organisations Typically Start Their Automation Journey

Most organisations begin by identifying one or two painful processes. These are usually processes that are repetitive, high-volume, and rule-based.

The next step is mapping the process clearly. Understanding how data flows today is critical before automating it.

Once the workflow is automated and stabilised, teams gain confidence and expand automation to other areas. Over time, automation becomes part of the organisation’s operating model rather than a side project.

Workflow Automation as a Long Term Capability

The real value of workflow automation is not in one-time improvements. It lies in building a foundation that supports continuous optimisation.

As businesses grow, new systems are added, regulations change, and customer expectations evolve. Automated workflows can be adjusted, extended, and improved without rewriting everything from scratch.

This flexibility is especially important in financial services, where change is constant.

Workflow Automation as your backbone

Workflow automation is becoming a core capability for financial services organisations. It helps reduce manual work, improve accuracy, strengthen compliance, and scale operations without adding complexity.

Modern automation platforms make it possible to build reliable workflows that reflect real business processes instead of forcing teams to adapt to rigid tools.

By starting small and expanding thoughtfully, organisations can create a strong automation backbone that supports growth for years to come.