Mutual fund distributors earn their income through commissions paid by asset management companies, commonly known as AMCs. For anyone entering the mutual fund distribution business, understanding how distributor commission works is essential for building a sustainable long term income.

This guide explains mutual fund distributor commission in simple terms, including how it is calculated, the types of commission, and why trail commission plays a key role in long term earnings.

What is mutual fund distributor commission?

Mutual fund distributor commission is the payment a distributor receives for selling and servicing mutual fund investments. This commission is paid by the AMC and not directly by the investor.

The commission is usually built into the total expense ratio of a mutual fund scheme. Investors do not see a separate charge, but the distributor is compensated for onboarding clients, handling documentation, and providing ongoing service.

In India, mutual fund distribution and commission structures are governed by SEBI regulations and industry guidelines from AMFI.

Who is eligible to earn distributor commission?

To earn mutual fund distributor commission in India, a person or entity must:

- Hold a valid AMFI Registration Number (ARN)

- Pass the required certification exam

- Be empanelled with one or more AMCs

- Follow all regulatory and compliance requirements

Once registered, the distributor becomes eligible to receive commissions on investments made through their ARN.

Types of mutual fund distributor commission

1. Upfront commission

Upfront commission is a one time payment made shortly after an investment is completed. It is calculated as a percentage of the investment amount.

Example: If an investor invests ₹1,00,000 and the upfront commission rate is 1 percent, the distributor earns ₹1,000 as a one time payment.

In recent years, regulators have encouraged a shift away from upfront heavy models to reduce mis selling and promote long term investor interest.

2. Trail commission

Trail commission is an ongoing commission paid to the distributor as long as the investor remains invested in the mutual fund scheme.

Trail commission is usually calculated as a percentage of the assets under management (AUM).

Example: If a distributor manages ₹50 lakh of AUM and the trail rate is 0.75 percent per year, the distributor earns approximately ₹37,500 annually. This amount is usually paid monthly or quarterly.

Trail commission forms the backbone of long term income for most professional distributors.

Why trail commission is more important than upfront commission

Trail commission is considered healthier for both distributors and investors because:

- Income is recurring and predictable

- Distributor focus shifts to long term client retention

- Earnings grow as AUM grows

- Business becomes more stable over time

A distributor who builds long term relationships can earn steady income even without continuously onboarding new clients.

How mutual fund distributor commission is calculated

Commission calculation depends on multiple factors, including:

- Scheme category such as equity, debt, or hybrid

- AUM value

- Applicable commission rate

- Duration for which the investment is held

Trail commission is often calculated using average AUM. In real systems, AMCs may use daily average assets, which means exact payouts can vary slightly month to month.

Because of these variables, distributors often use estimation tools rather than manual calculations.

Understanding year wise commission structure

Many AMCs define trail commission rates based on how long the investment stays active. A common structure looks like this:

- Year 1 commission rate

- Year 2 commission rate

- Year 3 commission rate

- Year 4 onwards commission rate

For example, an AMC may offer 0.75 percent trail for the first three years and 0.60 percent from the fourth year onwards. This structure rewards distributors for long term client retention rather than short term sales.

How SIP investments affect distributor commission

SIPs build AUM gradually over time. Each monthly installment starts earning returns as soon as it is invested. Because of this, early SIP installments stay invested longer, AUM grows month by month, and trail commission increases gradually.

In the first year, end AUM is often higher than the total SIP amount invested because of market returns and compounding. This directly impacts trail commission earnings.

Common commission ranges in India

Actual commission rates vary by AMC, scheme, and distributor category. Approximate ranges are:

- Equity funds: 0.50 percent to 1.00 percent trail per year

- Debt funds: 0.20 percent to 0.60 percent trail per year

- Hybrid funds: typically between equity and debt rates

These numbers are indicative and can change based on AMC policies and regulatory updates.

How distributors receive commission payments

- Investor makes an investment through a distributor

- Registrar and transfer agent calculates eligible commission

- AMC processes commission based on reports

- Commission is credited to the distributor’s registered bank account

Payout frequency is usually monthly, though exact timelines vary across AMCs.

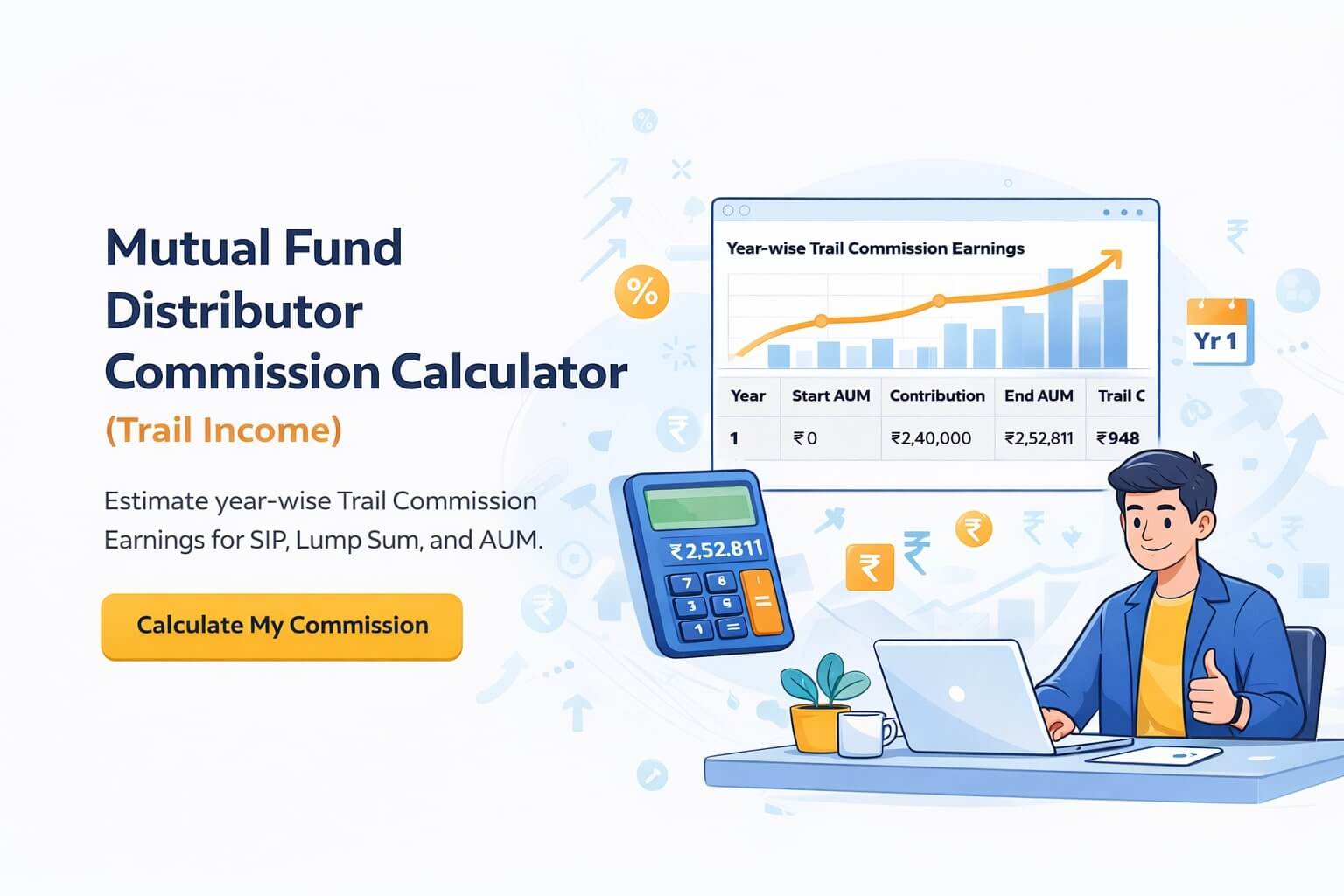

Why commission calculators are useful for distributors

Manual commission calculation becomes difficult when handling multiple clients and SIPs. A commission calculator helps distributors:

- Estimate monthly and yearly earnings

- Understand long term income potential

- Plan business growth targets

- Explain earnings logic to team members

A calculator that shows year wise trail commission gives better clarity than a simple one line estimate.

Is mutual fund distributor commission fixed?

No. Distributor commission is not fixed. It can change due to:

- AMC policy updates

- Scheme expense ratio changes

- Regulatory changes

- Client redemptions or exits

Because of this, commission calculators should be treated as estimation tools rather than exact payout predictors.

Frequently asked questions

Final thoughts

Mutual fund distributor commission is the foundation of the distribution business. While upfront commission provides short term income, trail commission builds long term financial stability.

Understanding how commission works, how it grows over time, and how year wise structures impact earnings helps distributors build better businesses. For practical planning, using a commission calculator alongside this knowledge provides clarity and confidence.