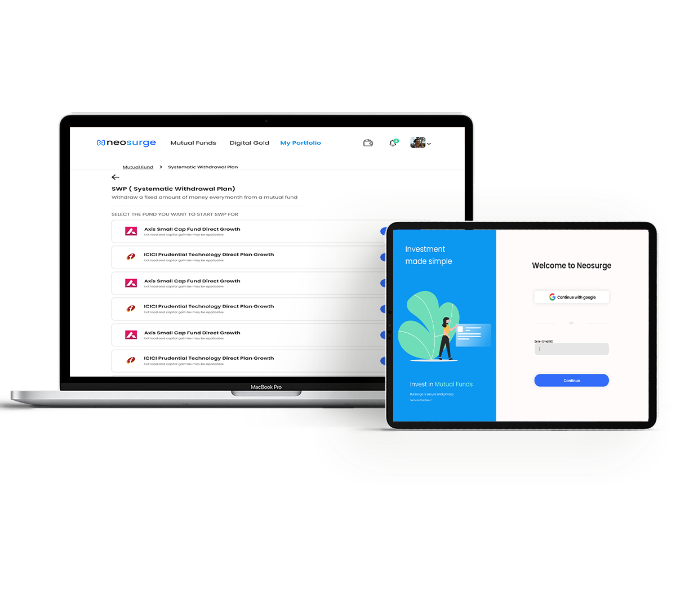

Neosurge

Case Study

Neosurge, is an Eco System for the mutual funds investments. This system helps the investors to self serve, from each and every step including from onboarding, KYC, Risk Profiling, Goal Management, Portfolio Suggestion to the investor , Analysis, SIP, STP, Switch In/out , e-mandate and other payment options. It also provides assisted services through which users can invest based on the research done by neosurge team.

Overview

and plan ahead

The client wanted to build an ecosystem, where the entire system had to be automated as much as possible, so that their customers would do mutual fund and gold transactions without much of hasstle. They also wanted to build an assisted services for first time investors.

The challenging part was to design a sleek interface for his requirement, and to fetch required data from various vendors like BSE to be displayed in the app with several calculations and formulas.

Solution and steps taken

Our team brainstormed with the client on multiple sessions and came up with an amazing solution for the platform, and below are few modules

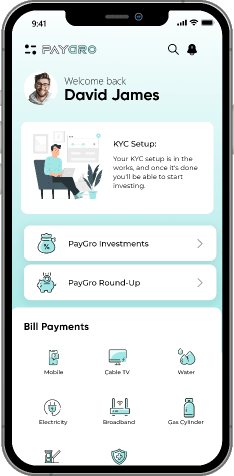

Customer Onboarding

User onboarding entails a variety of tasks, including assessing potential customers, ensuring credit process adherence, ensuring legal agreements, creating a new account, and making the customer in accordance with the bank's market strategy and government regulations.

ekyc

The method of electronically checking a customer's credentials is known as paperless KYC. It's a method of digitally verifying information.

Risk Profiling

Professional advisers use risk profiling to help assess the best degree of investment risk for their customers. Risk profiling is used to determine a client's required return (and therefore risk) in order to achieve their investment goals, as well as their risk potential and risk tolerance.

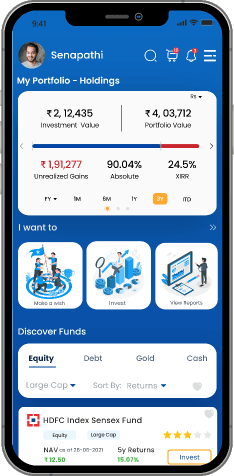

Goal Management

Rather than relying on achieving the best possible portfolio yield or beating the index, the client tests his customers' success against basic life goals, such as investing toward children's college or creating a retirement nest-egg.

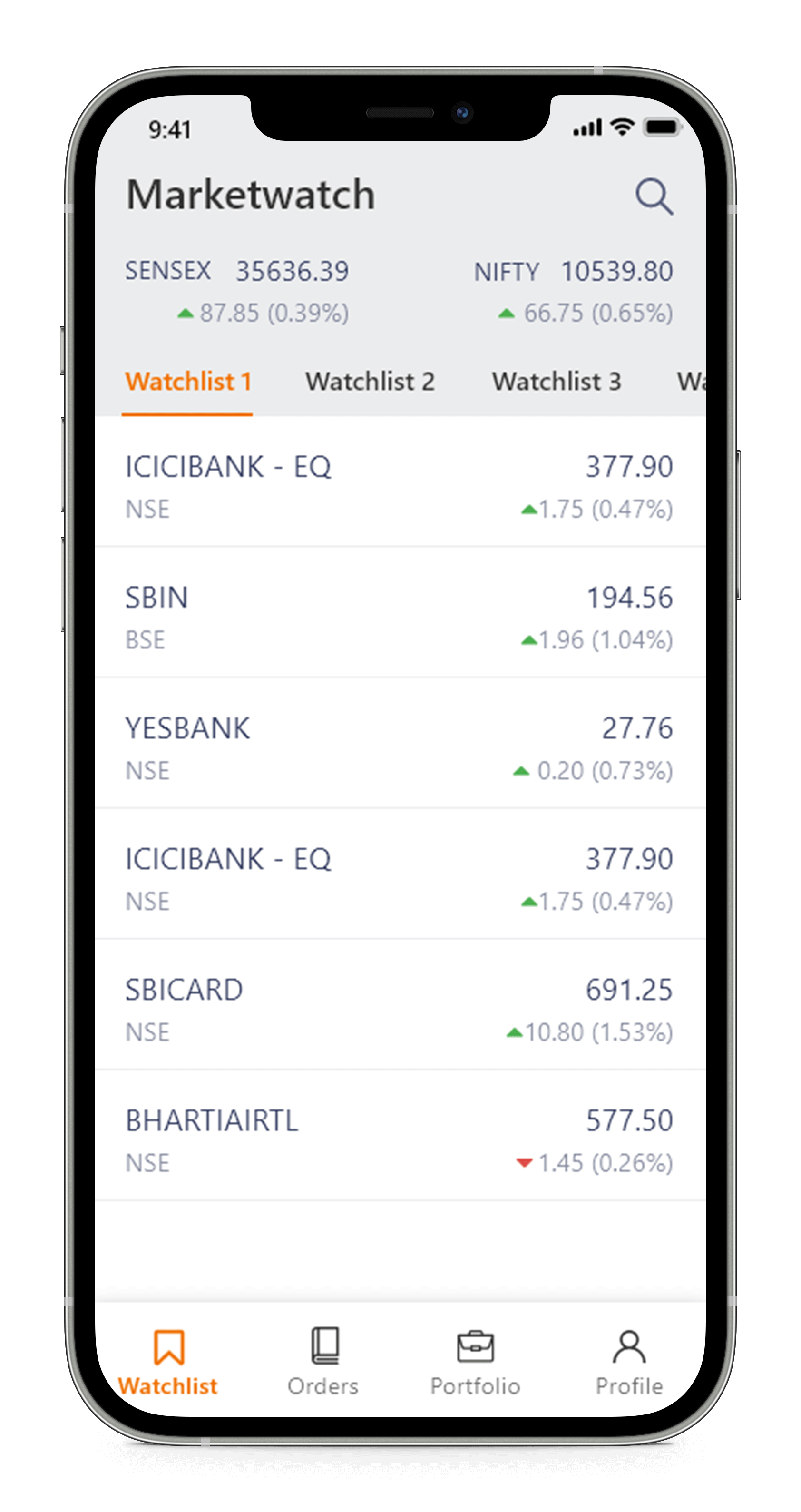

Analytics

We built portfolio analysis which is one of the facets of wealth management that allows market investors to assess and measure a portfolio's output.

e-Mandate Integration

We integrated e-Mandate payment software. It provides the infrastructure for companies in India to receive recurring payments.

Gold Investments

We integrated APIs for neosurge to invest in gold both through lumpsum and SIP.

Assisted Services

Custom algorithms for assisted services were implemented according to neosurge's requirements for first time investors

Results and

Conclusion

When the client came to us with an idea, It was challenging for us to guide him on design and technology part becasue we had to brainstorm several times with the client and come up with a solution. We built a user friendly interface for the mobile app and connected several API's with the app and the backend database

This is an ongoing project and we are adding new modules and functionalities to the platform, which help's our client to carry on his business in a smooth and efficient way!

Success stories

It’s not a success if there’s only one winner

We have worked relentlessly to step up our game and enter the competitive realm, and the benefit was never ours alone. Our success stories are comprised of our clients’ success stories, and that’s something we massively cherish.